Global economy: too slow for too long

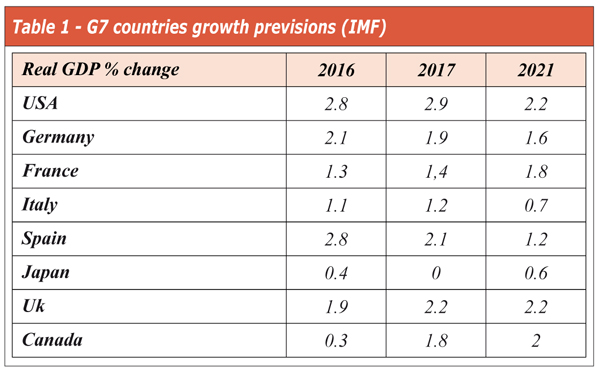

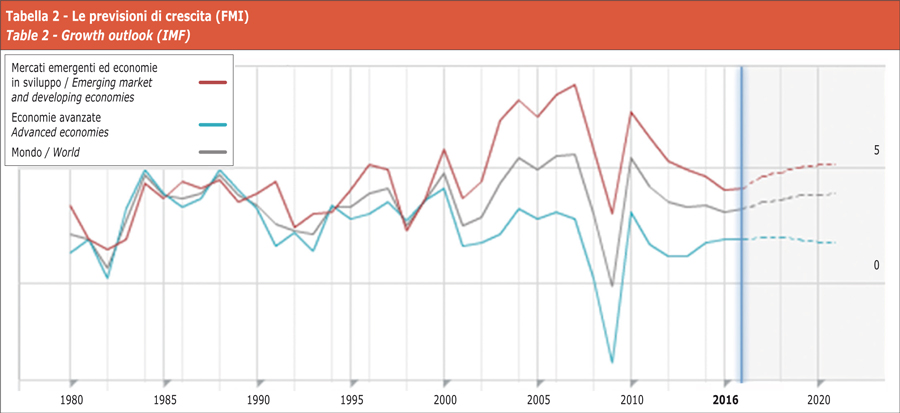

Too slow for too long: the title of the World Economic Outlook (WEO)1, published on April is not a good provision. According to the economists of the IMF (International Monetary Fund), the global growth in 2016 is a modest 3.2%, corresponding to a 0.2% downward revision relative to the January 2016 prevision. Notwithstanding the recovery is projected to strengthen in 2017 and beyond, the increased of uncertainty is a concern.

Whereas growth in advanced economies is weak, the expected acceleration is driven primarily by the robust growth in emerging markets, whose realization will depend on a few not negligible factors:

- gradual normalization of conditions in the systems currently under pressure;

- positive reorganization of the Chinese economy;increased activity in the commodity exporting emerging market economies;

- growth without shocks in the remaining economies in the developing world.

A COMPLEX SCENARIO

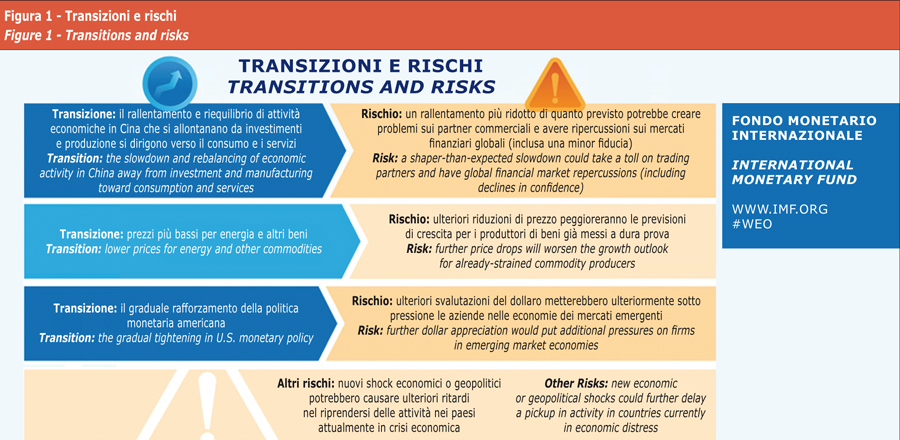

China is going through a very important transition towards a more sustainable growth based on consumption and services, which in the end will spread worldwide, but in the meantime, there are negative effects especially in emerging markets. On the other hand the demand, and especially the investments demand, remains weak particularly in the commodity exporting countries, whose transactions collapsed.

Although in principle this phenomenon should result in symmetrical benefits for importing countries, the negative effects on producers have so far dominated the economic scene, with similar dynamics to those of the 1929-1939 decade.

Therefore today the probability that the scenario assumed by the WEO will realize is more low, and consequently the risk of a weakening global economy is higher.

The main consequence of this economic weakness is the urgent need for far-reaching measures to handle the increased vulnerability.

According to the IMF economists such measures should be structured based on three characteristics:

- structural reforms to boost investment and productivity;

- accommodative monetary policies to counter deflationary pressures and growth-friendly tax policies to support demand;

- the authorities in emerging markets should focus on containing problems originated by macroeconomic and financial effects.

A COLLECTIVE MACROECONOMIC MEASURE?

If there was a significant decrease in the growth rate, to put away the global economy from a new downward spiral, it could be necessary a “collective macroeconomic policy” that strengthens the power of inspection and control of financial institutions in order to mitigate the fallout of the non-economic shock.

Both the US and in Europe the political debate is shifting towards protectionist closure practices because, according to the IMF analysts, income inequality derived from globalization, which favoured economic elites abandoning others to their fate, and fears related to the escalation of terrorism.

Also the tragedy of the refugees from Middle Eastern countries and the migratory movements linked to natural disasters (primarily El Niño), as well as considered as a threat by the advanced economies, worsen the conditions of poverty in developing countries and emerging markets.

Well-designed tax reforms may create demand, employment and improve social cohesion even without burden the budget of individual states, while reforms in the financial sector could not only improve stability, but assist the monetary and fiscal policy.

“Lower growth means less room for error” said Maurice Obstfeld, IMF Economic Counsellor and Director of Research “The current deterioration of the outlook and the negative consequences associated require an immediate response”.

If the political leaders of nations will recognize the risks all countries are exposed to and will share the measures needed to shelter the economy, the positive impact on global confidence levels will be substantial with a strengthening of growth preventing further delay in the recovery.

OPPORTUNITIES TO WIN THE GLOBAL COMPETITIVE CHALLENGE

World economic growth is still low because China and Brazil, which in recent years were the main engine of growth, in the near future are under braking.

European monetary policy and the same as the Japanese one is still expansionary. The central bankers have two main objectives:

- Increase investments. A lot of cash is available to encourage investments thanks to the low interest rates granted by the central banks;

- Encourage exports. Low interest rates have devaluating effects on currencies. Due to the devaluation of the euro, european exporters will benefit in the international competitive challenge.

The traditional sectors of the “Made in Italy” will be able to benefit from the euro weakness in terms of competitiveness on international markets?

Currencies management within companies is a critical resource to safeguard the performance. Today there are technologically advanced tools enabling an immediate and user friendly use thanks to the digital technologies.

“Fintech” is an acronym to identify the new technologies applied to the finance. A useful resource for companies in the currencies management is, for example, the Fintech platform created by eKuota (www.ekuota.com). A management tool that helps to manage the risks arising from the financial markets. The management of exchange rates represents a competitive advantage that needs a structured and organic management.

The currency transactions in financial markets are complex. The temptation is to apply to the domestic currency (the Euro) neglecting all the aspects relating to foreign currency transactions. It’s a big mistake that does not allow to seize market opportunities and to lose competitiveness against the best equipped competitors.

The decision whether or not to retain the exchange rate risk within the company to allow tactically differentiated pricing policy for different currency area is a crucial strategic activity in a highly complex global scenario. The advice is to gear up properly using the most appropriate tools available today.

Laura Oliva & Giovanna Bernasconi

Ekuota, Milan

(Source: Elevatori May / June 2016)